If Bitcoin really is a safe-haven asset,

is it behaving like one?

The title of today’s post is not intended to be a serious question as much as it is “gallows humour”, as they say.

Since the Russian invasion of the Ukraine in early 2022, it’s been speculated that future historians may look back on that event as the beginning of WWIII. I have privately wondered (and meant to write it up in the last monthly letter, but it slipped off the radar), whether the cascading military coups throughout the CFA (Central African Franc) nations were the slow opening of a second front in what was becoming a global conflict.

As the ruling, CFA-aligned governments are being deposed, in Niger, Ghana, Central African Republic and Burkina Faso (eight coups in the past two years, so far), Russian military advisors are appearing on scene, coaching the generals. Meanwhile China is ready with infrastructure incentives and loans. That front isn’t hot – yet – but it’s – “War By Other Means”, to quote the Robert Blackwell & Jennifer Harris book by that title…

“Today, nations increasingly carry out geopolitical combat through economic means. Policies governing everything from trade and investment to energy and exchange rates are wielded as tools to win diplomatic allies, punish adversaries, and coerce those in between.”

Except for the United States, the authors lament, both of whom belong to the Council on Foreign Relations. The USA is still somewhat retrograde in that it reflexively seeks to use its military stature to either threaten or force issues – an increasingly obsolete strategy.

I’ve mentioned 5th Generation Warfare before (5GW), which is all about “war by other means” – so much so that at least one of the combatants may not even realize that they’re embroiled in a war:

“In 5GW, violence is so dispersed that the losing side may never realize that it has been conquered. The very secrecy of 5GW makes it the hardest generation of war to study. Because 5GW attacks occur below the threshold of observation, COIN in 5GW is the preemptive, system-wide, automatic degeneration of 5GW forces into more primitive gradients of warfare. The 5GW warfighter hides in the static, and the most successful 5GWs are those that are never identified.”

Abbott, Daniel H.. The Handbook of 5GW: A Fifth Generation of War? (pp. 16-17). Nimble Books LLC. Kindle Edition.

I think this has been the case in the West for decades, with the rise of far-left ideologies and bat-shit wokery permeating (infiltrating?) our core institutions (basically, Fabianism writ large).

Yet as I type this, it is still early days in a new hot war in the Middle East, which is possibly – if you listen to Patrick Byrne’s theory on how it occurred – the side-effect of a geo-economic battle between the US and Israel of all things.

What REALLY Caused Israel's Foggy Intel? Read it Here 1st.

— Patrick Byrne (@PatrickByrne) October 12, 2023

The MSM has the what and the why, but not the how. Let me tell you what really caused this catastrophic failure in Israeli intelligence last Saturday.

As my regulars are aware, I have spent some time this year in… pic.twitter.com/8uR0QzSupB

In any case, it’s another 9/11 moment and at some point I’ll explain why I use that comparison specifically, instead of the “Pearl Harbor” references we’ve seen a lot of since the Hamas surprise attack on Israel (possibly in the monthly macro Bitcoin Capitalist if I don’t get to it here).

The mid-month portfolio review issue is intended to be a more tactical focus on Bitcoin, cryptos and the companies we own, within the backdrop of whatever is going on that affects these spaces directly.

But the dial for geopolitical tension just got ratcheted up to 11, so we have to acknowledge here that something very bad has occurred, and like it or not, it stands to become a core driver of what unfolds from here on.

Hedge fund billionaire Paul Tudor Jones appeared on CNBC October 10th, saying that it was hard to own stocks amid such geopolitical uncertainty, and citing three flashpoints: Ukraine, the Middle-East, and sooner or later: Taiwan.

In a widely circulated quote, PTJ said he liked gold and Bitcoin although he said so within the context of the two performing well in recessions, which he predicted would occur by Q1 of 2024.

I don’t necessarily know if that’s true. Bitcoin has never been in an official recession, although when we were in a “technical” one earlier this year, it was coming off the lows of a bear market nadir with a good head of steam on it, so I don’t know how much we can infer from that.

Recall, Paul Tudor Jones was arguably one of the catalysts behind “the institutions are coming” mantra of the 2020 cycle when he disclosed holding a position in it within his hedge fund.

As I’ve observed since, that wave, which included Michael Saylor, Stanley Druckenmiller and (for a while) Elon Musk, wasn’t really an institutional wave, per se – more like a vanguard of maverick billionaires. But it was a start.

It’s the inevitable, perhaps even imminent arrival of spot Bitcoin ETFs in the USA (they’ve been around here in Canada for years) that will truly lay out a carpet for institutional investors.

But the geopolitical and macroeconomic environment today is very different from anything experienced since Bitcoin emerged as an asset class.

The great bond supercycle is over, as is The Everything Bubble and likewise is the (so-called) “unipolar world”.

We’re neck deep in The Jackpot now , or what Strauss and Howe called a “Fourth Turning”.

The End of The Unipolar World (as we know it).

All bets are off, and nobody really knows what happens next. When people use the phrase “the end of the unipolar world”, they are typically thinking in terms of nation states jockeying for primacy in a presumably multi-polar world. Russia, China, Brasil, India, Turkey, Saudi Arabia, Israel… Iran – I think this is a one-dimensional view and doesn’t fully capture the shift we are undergoing.

But for my own meaning of “multi-polar world”, the potpourri of nation states vying for geopolitical “Lebensraum” is only one layer of it. Add to that non-aligned, non-national, autonomous organizations …think supra-national Borgs like the WEF, and their polar opposite: Network States and crypto-anarchist enclaves.

Some countries may coagulate into the former (like the entire G-20) while others splinter out and morph into the latter (El Salvador).

Then

factor in cartels, consortiums and corporations. Terrorist cells,

organized crime, hacker networks, not to mention completely artificial

entities with no human agency – like smart contracts, DAO’s, autonomous 3-D printers, weaponized drones or computer viruses.

Now imagine decentralized, anonymous (and autonomous) networks of 3-D printers cranking out kamikaze drones that take them out. pic.twitter.com/kaWClCBLQx

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) October 7, 2023

That’s the multi-polar world we are headed into, and we’re naive if we think we’re just dealing with a bunch of nationalist upstarts. In such a world, Bitcoin “the money of enemies” becomes necessity.

Where does it leave Bitcoin?

Until now it has only really had one long macro-economic cycle, with relative geopolitical stability, during which it was always theorized that Bitcoin was a safe haven asset, just like gold.

Couple problems.

One is that over the past fifteen years or so, not even gold traded like gold. It was supposed to be safe when everything else went to hell, but in the Global Financial Crisis and every other mini-crisis that tanked the stock market, gold usually tanked too.

Yes, gold took off like a rocket after the GFC bottomed, and did so a good six months before everything else. But for the most part, everything took off and highly correlated markets became the norm for the next ten or fifteen years, because “money printer go brrrr”.

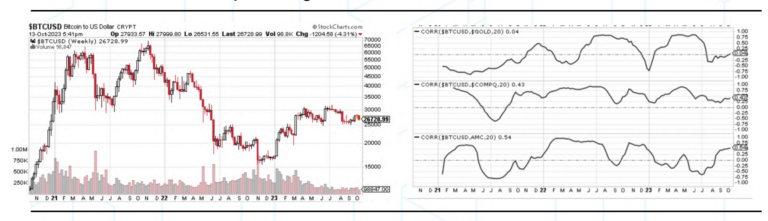

That gave rise to the mantra, “it’s all one trade”. During that same cycle, Bitcoin tracked the Nasdaq for long chunks of it, and even traded like a meme stock – the right hand chart above showing correlations between BTC and Gold (top), the Nasdaq (middle) and AMC (bottom). The closer the line tracks along the top, the closer the correlation.

Now we’re in what seems like a global crisis for reals.

Bonds have had a somewhat under the radar implosion, owing to the fastest rate hike cycle in history. Stocks have done something barely recognizable, and gone down for a few months; debt is exploding at an accelerating pace, as if that was even possible; and that’s on top of: rolling energy crises, a hot war in Europe, escalating tensions between China and Taiwan and now, the Middle East erupting into war.

Gold has reacted vigorously to the Hamas attacks on Israel, and the anticipated reprisals and repercussions (a more than $60/oz move on Friday the 13th alone).

Bitcoin looked asleep, when a new hot war broke out in the Middle East. If it’s been reacting to anything since that happened it seems to be the ongoing breakdown of the bond markets. It may truly “be different this time” if the markets wake up to the reality that debt is well and truly out of control.

Granted, gold took a major dump in the weeks leading up to the Hamas attacks, and Bitcoin is still the best performing asset class of the year, so if we can infer anything, it feels like the “all one trade” correlation is starting to break down a bit.

Absent rampant money printing (on pause for the moment, to be sure), assets seem to be zig-zagging toward their own fundamental drivers and at the moment, it looks like this: fears of World War III are acting as a tailwind for gold while fears of the global financial system imploding (and possibly the inevitable arrival of CBDC’s) are what’s lifting Bitcoin.

My base case is that the latter is pretty well baked in. I’d like to hope that the former isn’t, but, as I noted earlier, we may already be past that.

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops, sign up today.

Today’s post was an excerpt from The Bitcoin Capitalist Mid-Month Portfolio Review. TBC provides actionable intelligence on the macro forces shaping Late Stage Globalism and a tactical toolkit for growing your wealth as it plays out. Try it today here.