Authored by Jeffrey Tucker via The Epoch Times,

The price of gold is once again testing its all-time highs as both individuals and institutions flee the chaos of our times toward safety. What John Maynard Keynes decried as the “barbarous relic” just keeps coming back. The worse government policies become, and the more deranged and dysfunctional the Federal Reserve is revealed to be, the more people are turning to time-tested monetary truth.

In a sense, the price of gold can often work as a barometer of confidence in the central managers. The higher it goes, the less trust in the system there truly is. For a century, the elites have wanted gold to disappear from the subject of money. But it keeps not happening.

Like clockwork, there is renewed interest even in the old gold standard. According to Yahoo finance:

“Rep. Alex Mooney (R-WV)—joined by Reps. Andy Biggs (R-AZ) and Paul Gosar (R-AZ)—introduced H.R. 2435, the Gold Standard Restoration Act, to facilitate the repegging of the volatile Federal Reserve note to a fixed weight of gold bullion.Upon passage of H.R. 2435, the U.S. Treasury and the Federal Reserve are given 24 months to publicly disclose all gold holdings and gold transactions, after which time the Federal Reserve note dollar would be formally repegged to a fixed weight of gold at its then-market price.”

The timing is more brilliant than it appears. The dollar as the international reserve currency—which it has been since 1944—is newly under threat. China, Russia, India, Saudi Arabia, and Brazil, with other nations joining, have all agreed to work toward independence from the dollar. This is because the Biden administration has so heavily politicized its use as a reserve currency, even going so far as outright confiscation of assets owned by Russians. U.S. policy is using the dollar as a weapon, and it should come as no surprise that many nations don’t like that.

There is the additional and very real threat, too, of a Central Bank Digital Currency in which the Biden administration has shown great interest.

This would permit a massive invasion by the government and its monetary oligarchs into our private lives and permit new levels of population control that will make the Bill of Rights a dead letter.

If there were ever a time to push for a new gold standard, it is now. At the same time, it should have happened 43 years ago when the Reagan administration had the chance to do so. This might have been the key to preserving newly restored American freedoms rather than allowing the central bank to preside over the wreckage of this country.

The presidential campaign of 1980 was a turning point for the United States, away from the economic malaise of a highly regulated industrial sector with a dollar rapidly declining in value, toward deregulation and sounder money. Looking back, the dramatic policy turn of the Reagan presidency prepared the groundwork for decades of prosperity. It built a capital base so strong that it seemed nothing could wreck it.

An unfulfilled part of the 1980 Republican Party platform—pushed by David Stockman and George Gilder—was an endorsement of a gold standard; that is, the dollar redefined in terms of gold instead of the floating paper nothing it had been since the catastrophic reforms made by Richard Nixon that unleashed a decade of inflation.

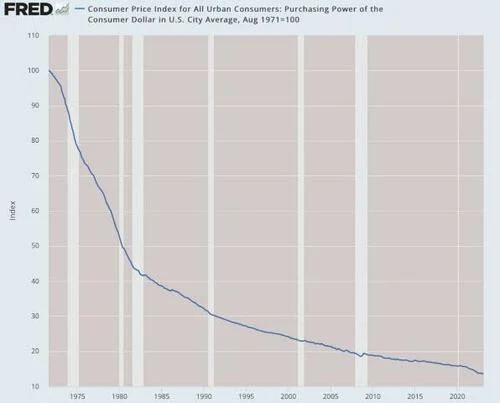

That part of the 1980 platform was neglected. As a result of the Nixon reform, and the failure to reverse that disaster, the dollar of Aug. 13, 1971, is now worth about 13 cents.

|

| (Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker) |

That is a tragedy. With a gold standard in place, and the end of the Cold War only 8 years away, the United States was perfectly positioned to reestablish itself as the peaceful commercial Republic that it was founded to be rather than the entrenched global empire it became after 1990.

With the seemingly existential threat of Soviet communism out of the way, the United States could have chosen George Washington’s path as he stated in his Farewell Address. “The great rule of conduct for us, in regard to foreign nations,” he said, “is, in extending our commercial relations, to have with them as little political connection as possible. So far as we have already formed engagements, let them be fulfilled with perfect good faith. Here let us stop.”

Instead of that path, the United States under the first George Bush immediately set out on another imperial crusade for democracy and nation-building. No longer restrained by Cold War calculations and mutually assured destruction, the United States was the winner in the struggle, throwing away its chance for peace and prosperity with wars in Haiti, Panama, and Iraq, stirring up hatreds in faraway lands that a decade later came home in horrifying acts of terrorism on our own soil. A whole region of the world now lies in ruins, and Europe is destabilized with war refugees.

Why did the United States take this course when it so obviously could have been otherwise? The short answer is that it could. And the reason it could was because the Federal Reserve’s paper money regime would pay the bills. Paper money has been the handmaiden of war and empire since the ancient world, and the worst example is the 20th century itself.

It is highly doubtful that there ever would have been a thing called a “world war”—grotesquely called the Great War at the time—had both Europe and the United States not adopted central banks. The monetary math would not have made it possible. They would have chosen diplomacy over war.

The astute economist Benjamin Anderson proved it in his postwar treatise on the subject. It’s true that most currencies in the world back then were backed by gold but the critical service the central banks provided was to become a buyer of last resort of government debt. This became a grave moral hazard back then just as it is today.

But let’s return to 1980. Instead of a gold standard, we got better and wiser money management by the Federal Reserve under Paul Volcker, who wrenched the paper excess out of the system and set the dollar up for decades of relatively low inflation. He did nothing, however, to put an end to policy discretion.

Instead of following through on the gold standard, Reagan appointed a commission to study the issue. We know what that means! Of course the commission was packed with paper-money fans with the gold-standard partisans in the minority. The minority report of that commission remains a genuine classic of monetary analysis. The lead author was none other than Ron Paul, who has been fighting for sound money his entire career.

The case for a gold standard is bound up with the case for a limited government that follows the Constitution and protects the rights of the people. That is precisely the problem that people have with the idea. It would put a hard stop on Federal Reserve monetary discretion. It would also require that the whole of the federal government balance its budget the same way that states have to today. Lacking a central bank with the power to print unto infinity, vast numbers of the debates we have today about federal policy, domestic and foreign, would melt away.

The great flaw in the gold standard, however, is not its logic or virtue but its political and managerial probability. The agenda has always required that the existing managers of the system as it exists also come around to the view that they should have less power and less discretion. It depends fundamentally on the existing monetary oligarchs choosing a path that is good for society rather than themselves. That, sadly, seems quite unlikely.

A path even wiser than a centralized gold standard would be the complete denationalization of money itself. This could happen with a repeal of legal tender laws and a wholesale liberalization of both gold as money and digital money that works like gold such as Bitcoin and its many decentralized cousins. We have the technology to make this happen. What’s missing is the political will.

As in 1980, we are at another turning point. With the dollar as the international reserve currency facing its biggest challenge since World War II, and the domestic value of paper money losing its reliability by the day, we do need dramatic reform. At this stage, we face a choice: more tyranny enabled by the nightmare of a CDBC or monetary deregulation that would allow markets and people to choose their own preferred means of exchange.