By Michael Every of Rabobank

Because Markets, Because Marxists

Yesterday saw benchmark European TTF gas go negative(!) due to warm weather, which in no way means an end to the structural energy crisis. Markets also reacted to two major developments in no way conclusions to larger stories.

In the UK, Gilt yields tumbled as Rishi Sunak became PM. 2-years were down 37bp on the day and 10-years 31bp, while GBP was above 1.14 before getting a nosebleed. Of course, markets still expect UK rates to peak around 5%, a level that is going to break things. How Sunak can fix them remains to be seen, but austerity is unlikely to be the answer regardless of what Gilts think. Nonetheless, Truss is gone so all is well with the world, “because markets”.

In China, stocks slumped, and Hong Kong stocks collapsed the most following a CCP Congress since 1994: the US Nasdaq Golden Dragon market went up in a puff of smoke. “Stocks are disconnected to fundamentals,” as Bloomberg quotes somebody who did not see this coming on Friday. But which fundamentals? The Congress spoke about income and wealth distribution, and hammered home Common Prosperity. Either said optimist didn’t see this outcome, or didn’t think it mattered; in either case, why should anyone listen to them? CNY has dipped past 7.30 after a weak fixing, and CNH past 7.33, even as the PBOC has adjusted regulations to allow firms to borrow more from overseas. Remember the “wild” forecast CNY would ultimately sit north of 8?

Yet what happened yesterday is not going to “Truss up” China’s leadership and force a change of policy direction. Read Politburo member Wang Huning: his core belief is that markets exist only to serve a greater state goal, rather than getting to choose the head of state to serve their goals. Anyone who does not get that should not be talking Chinese markets. Indeed, Bloomberg today talks about the need for “Kremlinology With Chinese Characteristics” to understand China:

“At a time when understanding Beijing’s domestic and economic drivers has rarely mattered more, its leadership is insulated and the outside world is left to read tea leaves… Authoritarian politics is often elite politics, and understanding that requires interviews, interactions, and trust - not only at the national level, but in regional and local affairs as well.

With Moscow and Beijing building walls, the risks for investors, policymakers, ordinary citizens and everyone else have risen. One-way traffic and the ability to pick and choose encourages biases and means that too many will see what they want to see - as evidenced by reaction to the priority Xi gave to loyalty in promotions to the Politburo and its supreme Standing Committee.

Approaches and rigor matter, for all involved, as does cultural and linguistic knowledge, which governments and, indeed, businesses must encourage despite all the obvious obstacles. Otherwise, it is not just today’s watchers that will be hampered, but tomorrow’s as well.”

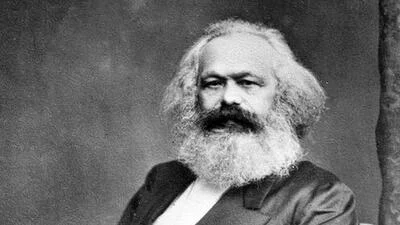

You will notice there is one word missing from the target list for understanding China, which was well known during original Kremlinology: ideology. It’s not just about who’s who (or Hu’s who), but what’s what: what do people *believe*? Why do markets find it so hard to realise this, and do related reading? Wall Street analysts will happily spend a weekend going through a set of accounts or an IMF report, but ask them to read ‘Das Kapital’, ‘The Grundrisse’, or ‘Imperialism, the Highest Stage of Capitalism’, and you get looked at as if you are an alien. I repeat yet again that we are hence getting recommendations from people who literally don’t understand what they are talking about.

That said, not everything is ‘revolutionary’. As the UK shows, markets can throw tantrums over what were once normal steps. Regarding China:

- There are suggestions PCR tests now have to be paid for, perhaps retrospectively too. The bill for Covid Zero is clearly high - but does the state have to shoulder it alone? Aren’t markets supposed to like this?

- There are whispers of tax audits of foreign companies - but aren’t we seeing the same tax trend around the world now tax cuts have been firmly rejected? Aren’t markets supposed to like this?

- Why couldn’t we see the introduction of a property tax, wealth taxes, and inheritance taxes? Every Western democracy has them! Yes, they could have a destabilising effects on the property market that underpinned Chinese growth, but which will now drag on GDP for years. However, if you are already in that hole, why not stop digging and start to build a different growth model? That’s not common prosperity, but common sense. Yes, markets won’t like it: so what?

- Might we see the financial sector forced to lower its fees; narrow the spread between loan and deposit rates; cut staff salaries; downsize; and reduce the range of services offered? This would be hugely popular - as opposed to removing bankers’ bonus caps and cutting top income tax rates. Again, markets would hate it: again, so what?

- Banks would then be worse-placed to face a wave of bad loans from the property sector, so more state action would surely be required (to what political end?) This would lean strongly on CNY. Again, markets would hate it. I’m not going to repeat what that would mean, except that the FX forecasters who projected a stronger CNY also shouldn’t be listened to.

In short, what markets-who-read-no-Marx are suddenly upset about can be reasonably construed as not being entirely unreasonable in the bigger picture. The real problem is that not having read Marx means one does not know that while the Communist Party Manifesto advocates for progressive income tax; abolition of inheritances and private property; abolition of child labor; free education; nationalization of transport and communication; centralization of credit via a national bank; and expansion of publicly-owned land --much of which has been normal in the West for decades-- such ‘regulatory reform’ is not what Marx actually wants.

By contrast, he exclaims, “Part of the bourgeoisie is desirous of redressing social grievances in order to secure the continued existence of bourgeois society. To this section belong economists, philanthropists, humanitarians, improvers of the condition of the working class, organisers of charity, members of societies for the prevention of cruelty to animals, temperance fanatics, hole-and-corner reformers of every imaginable kind… They desire the existing state of society, minus its revolutionary and disintegrating elements.” Marx wants a new state, including revolutionary and disintegrating elements.

I very much doubt that markets grasp this distinction, but it is more in line with their recent sell-off (and out of line with the City celebrating a new PM who has shown little grasp of its global implications).

Again, however, unlike the UK, the market is not going to Truss China up, “because Marxists.”