With inflation running rampant, unemployment falling, and wages soaring, the Jerome Powell-led Federal Reserve waited too long to reverse its ultra-low interest rate policies and a massive bond-buying program. This delay has now been called a "mistake" by former Fed Chairman Ben Bernanke.

Bernanke spoke with CNBC's Andrew Ross Sorkin in an interview during Monday's "Squawk Box" show. He told Sorkin, "The question is why did they delay that. ... Why did they delay their response? I think in retrospect, yes, it was a mistake."

Inflation has become one of the most severe threats to the economy. Bernanke said, "And I think they [Fed] agree it was a mistake." He explains why the Fed missed the window of opportunity to tighten:

"One of the reasons was that they wanted not to shock the market.

"Jay Powell was on my board during the Taper Tantrum in 2013, which was a very unpleasant experience. He wanted to avoid that kind of thing by giving people as much warning as possible. And so that gradualism was one of several reasons why the Fed didn't respond more quickly to the inflationary pressure in the middle of 2021," he said.

Powell, the defender of financial markets, got it wrong last year when inflation began to run higher than the Fed's 2% target, though Fed members widely said inflation would be "transitory." What's disturbing is inflation was not transitory, and the monetary wonks operating the printing presses clearly didn't understand. Their inability to tighten last summer has caused the Fed to be way behind the curve, hence today's oversized rate hikes.

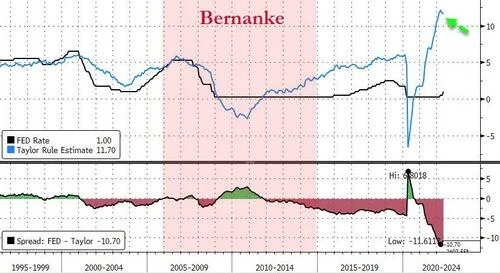

So how behind the curve is the Powell-led Fed? The Taylor Rule suggests Fed Funds should be over 11%, not around 1%. The Taylor rule is a formula that can predict or guide how central banks should alter interest rates due to changes in the economy.

Right now, Taylor's rule recommends that the Federal Reserve should continue to raise interest rates.

"There's a lot of support for the fact that the Fed is tightening now, even though obviously we see the effects in markets," Bernanke said. "You know, we'll see the effects in house prices, etc."

Meanwhile, the central bank is attempting to achieve a proverbial "soft landing," though there's an increasing risk of a recession in the not-too-distant future.

Powell and gang missed the window of opportunity to tighten policy rates and is now considered, well, in one former central banker's eyes, a "mistake." And with policy errors, hard landings are usually seen.

Watch the full interview here.