There are three certainties in life: death, taxes and a weekly dose of stock market pep talk from JPMorgan's head of global strategy, Marko Kolanovic. Today is an example of the third, because in the latest weekly JPMorgan View note, the Croat writes that with the Nasdaq officially sliding into correction early on Monday and stocks broadly sold, it is time to "buy the dip" as "markets can handle higher yields" (none of which is to be confused with another JPMorgan strategist, Mislav Matejka, saying exactly one week ago that it's time to stay bullish as "positive catalysts are not exhausted", which in turn followed the third JPM Croatian strategist, Dubravko Lakos-Bujas saying precisely the same in late December, urging traders to buy high-beta stocks (oops) and so on).

Extending up on a theme he first broached in late 2021 when he said that the recent oil spike is no reason for concern as the economy can comfortably handle a triple digit oil price without it eating away at growth, Kolanovic writes that "the pullback in risk assets in reaction to the Fed minutes is arguably overdone" because he predicts that "policy tightening is likely to be gradual and at a pace that risk assets should be able to handle, and is occurring in an environment of strong cyclical recovery."

Here, one could easily argue that this is a rather naive view, especially if the growing consensus of 4 rate hikes in 2022 coupled with some $300 billion in balance sheet runoff becomes reality, a consensus which has materialized in near market certainty of a March rate hike.

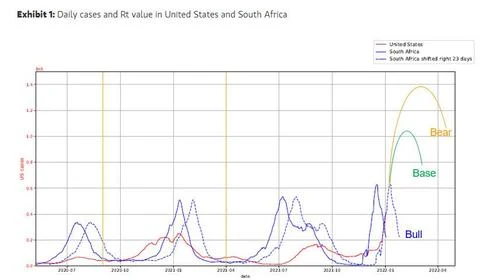

Yet one place where Kolanovic is certainly correct is his cheerful outlook on the outcome of the current Omicron wave, writing that while "the Omicron wave presents some downside risk to Q1 growth, we anticipate that cases will roll over sharply in the coming weeks, providing a boost to Q2. As this wave fades, it will likely mark the end of the pandemic, as Omicron’s lower severity and high transmissibility crowds out more severe variants and leads to broad natural immunity"

We stay positive on equities and expect Omicron will ultimately prove a positive for risk assets, as this milder but more transmissible variant speeds the transition from pandemic to endemic with a lower human toll.

Here even the rather bearish Morgan Stanley agrees, writing that its Omicron "bull case" is of a peak in 1-2 week with a base case of a peak in 3-6 weeks.

The strategist then also picks up where his colleague Mislav Matejka left off last Monday with his massive, 190-page equity strategy slideshow titled "Stay Bullish - positive catalysts are not exhausted" also sees blue skies on a fundamental basis, where he views the growth backdrop a staying supportive, with China activity deceleration now "largely behind us", and economic surprises in key regions are back in positive territory.

Marko also reminds us of what his colleague highlighted last week, namely that the Eurozone in particular stands out, with 2022 real GDP forecast at 4.6% yoy, above the US for the first time since 2016.

Going back to the US, and looking at what has emerged as the biggest fear in markets namely the spike in yields, he writes that "higher bond yields should not be disruptive for equities, but rather support our call for a Growth to Value rotation." Yet while he claims that the economy can handle higher yields, he also says that "we stay short 10y USTs, despite their recent selloff, as we see further scope for higher yields given still rich valuations and the hawkish shift in Fed expectations."

Finally, the Croatian notes that there are signs of supply constraints potentially passing their worst point, and of power prices surge easing while "inventories are very low and the labor market is staying strong." To validate his permabullish take, Kolanovic also sees gains for earnings, and believes that "consensus projections for 2022 will again prove too low." Regionally, we look for a better showing from EM/China, the UK and Europe. At a sector level, a likely pickup in bond yields will lead to more Cyclical leadership entering 2022.

In summary, the JPM quant believes that this week’s pattern is likely to repeat in 2022, offering buying opportunities on spread-widening in credit, and the bank remains "bullish on Oil given strong demand (that should easily absorb OPEC+’s agreed nominal production increase), light positioning, and limited producer hedging. We also stay long the agriculture complex on demand recovery (particularly for biofuel feedstocks), weather risks, and inventory tightness."

In short, JPMorgan sees nothing to worry about and urges its clients to BTFD, which is ironic because just moments ago his boss, Jamie Dimon appeared on CNBC and while also pushing the bullish case, warned of much more volatility to come in 2022 (i.e., lower risk prices) and said that he would be "surprised" if there are just four rate hikes this year.

Of course, how 5 or more rate hikes in one year is grounds for a bullish view is a mystery, although one which is easily answered if one simply assumes that JPM is merely looking for willing buyers to whatever residual risk inventory the bank is still hoping to offload. Then again, if that fails and things turn sour, JPMorgan will just precicipate another repo market crisis as it did in 2019 and quickly force Powell to abandon his hawkish intentions, sparking another furious rally across markets.

(Article by Tyler Durden republished from Zerohedge.com)