The owner of the world's largest crypto fortune, which stands at $96 billion, is likely an unsuspecting name that you wouldn't recognize: Changpeng Zhao.

But despite the fact that you've likely never heard of the Binance CEO, who now spends his time meeting with royalty and living in the United Arab Emirates, doesn't mean that he isn't gaining on the list of the world's richest people, on the tails of well known celebrity CEOs like Elon Musk and Jeff Bezos. In fact, he's richer than Asia’s richest person, Mukesh Ambani, the report notes.

Described by Bloomberg as a " former McDonald’s burger-flipper and software developer" turned "the most prominent personality" in the UAE's crypto scene. Zhao is a Canadian citizen who was born in China’s Jiangsu province.

And his fortune could be getting even larger: he still owns a significant amount of Bitcoin and Binance Coin, which was up 1300% last year.

Zhao's rise to riches hasn't come without its bumps in the road. Binance has been banned from China and is facing a number of regulatory probes globally, for example. The U.S. Department of Justice and Internal Revenue Service are probing one of his entities, Binance Holdings, has been used for money laundering and tax evasion.

The Commodity Futures Trading Commission is also looking into potential market manipulation and insider trading within the company, as well as whether it "illegally allowed U.S. clients to trade derivatives tied to cryptocurrencies," Bloomberg wrote.

The company's future will likely hinge on whether or not it can appease regulators. Usually, in our experience, we've found that there's a number that can stave off such probes. We'll have to see if Binance finds itself as lucky.

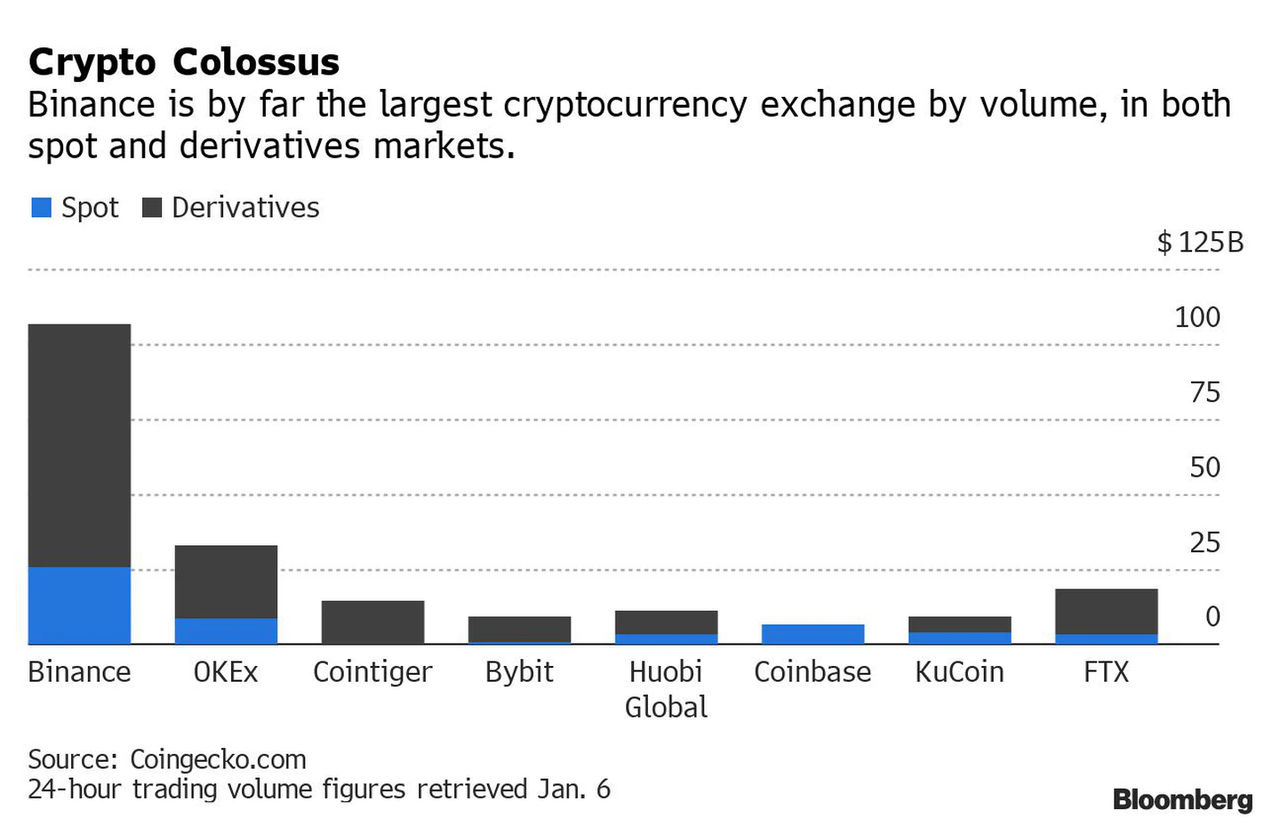

DA Davidson & Co. analyst Chris Brendler says that Binance generated at least $20 billion in revenue last year, about triple what is expected from Coinbase. In a recent 24 hour span, Binanace did a whopping $170 billion in transactions. A "slow day" is about $40 billion, Zhao said recently. “I don’t care about wealth, money, rankings,” he told Bloomberg in November.

“Coinbase might appear to be the 800-pound gorilla from a U.S. perspective, but Binance is significantly bigger,” Brendler told Bloomberg.

Binance responded: “Crypto is still in its growth stage. It is susceptible to higher levels of volatility. Any number you hear one day will be different from a number you hear the next day.”

Zhao's fortune likely hinges on whether or not he can meet regulators in the middle, which is why it's not surprising that he's embracing regulation. “I’m not an anarchist. I don’t believe human civilization is advanced enough to live in a world without rules,” he said in November.

Binance makes it revenue through holding hundreds of different crypto tokens, which they don't convert to traditional currencies. A favorable regulatory resolution will likely be paramount for the continued existence of some of these tokens.

Zhao said of the tokens: “We just hold them. If you calculate the number today, it’s one number, and 5 minutes later it’s a different number because every price is changing.”

Tim Swanson, head of market intelligence at Clearmatics, cites Binanace's user stickiness as part of their success: "They don’t even have to be the first to list a coin anymore for liquidity to aggregate there."

Binance's goal of being able to operate anywhere has made it tough for regulators to pin down to one location. Brendler commented: “Their approach was, ‘We don’t need a regulator, we are decentralized'. That worked really well for growing and scaling and product innovations.”

But now it's time to see how long that attitude can last. After all, Zhao's fortune may depend on it...